Types of 1031 Exchanges

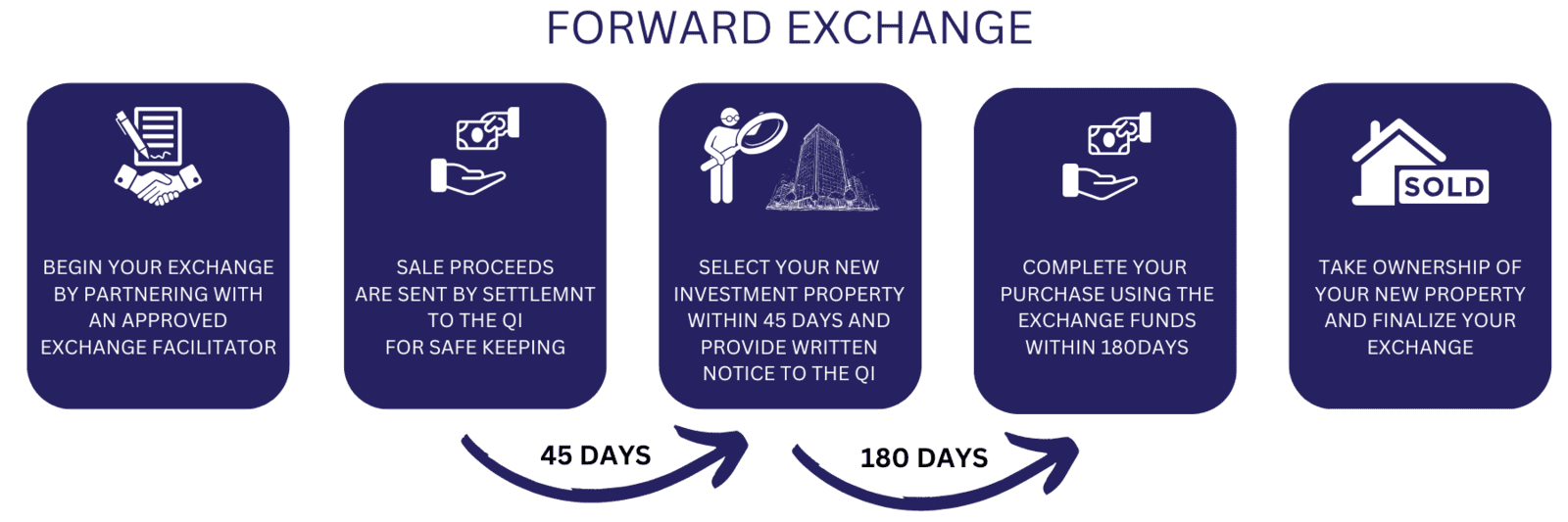

Forward Exchange (Delayed Exchange)

This is the most common and straightforward type. Think of it as selling first, buying second. Here's how it works: You sell your relinquished property, the funds go to a qualified intermediary, and then you acquire your replacement property within the required timeframes (45 days to identify, 180 days to close). It's like a relay race where you pass the baton (your investment) from one property to the next in a carefully timed sequence.

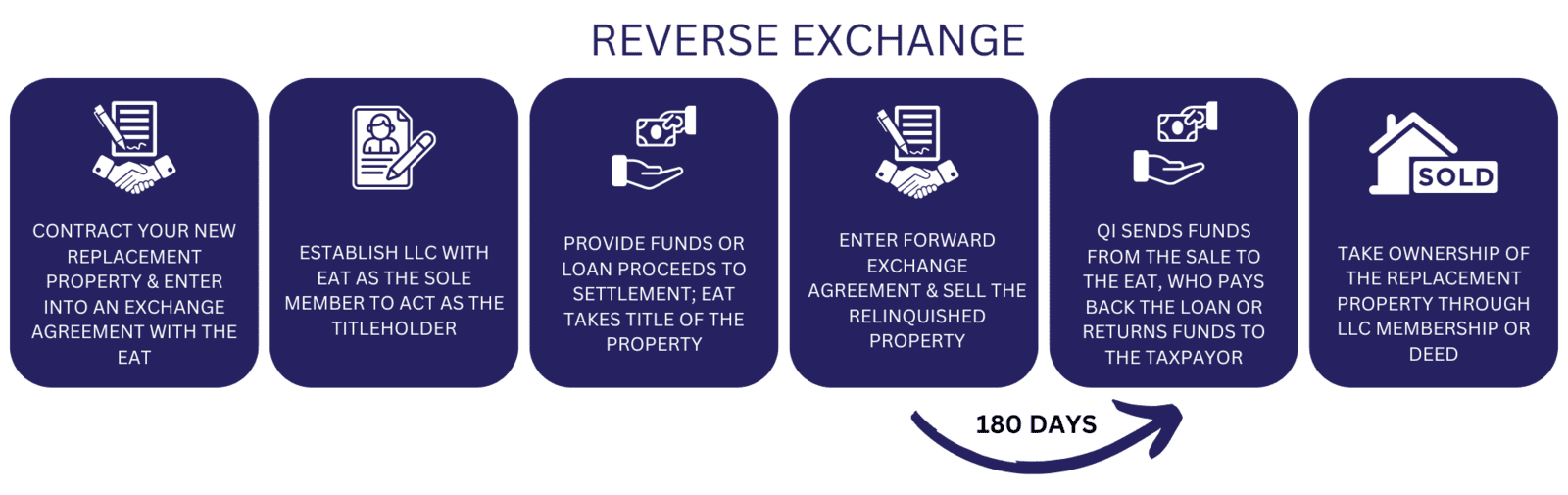

Reverse Exchange

As the name suggests, this is the opposite of a forward exchange – you acquire the replacement property before selling your relinquished property. This might happen when you find the perfect replacement property but haven't sold your current one yet. The IRS requires an Exchange Accommodation Titleholder (EAT) to hold title to one of the properties since you can't own both simultaneously for exchange purposes. You have 180 days to complete the entire transaction, including selling your relinquished property.

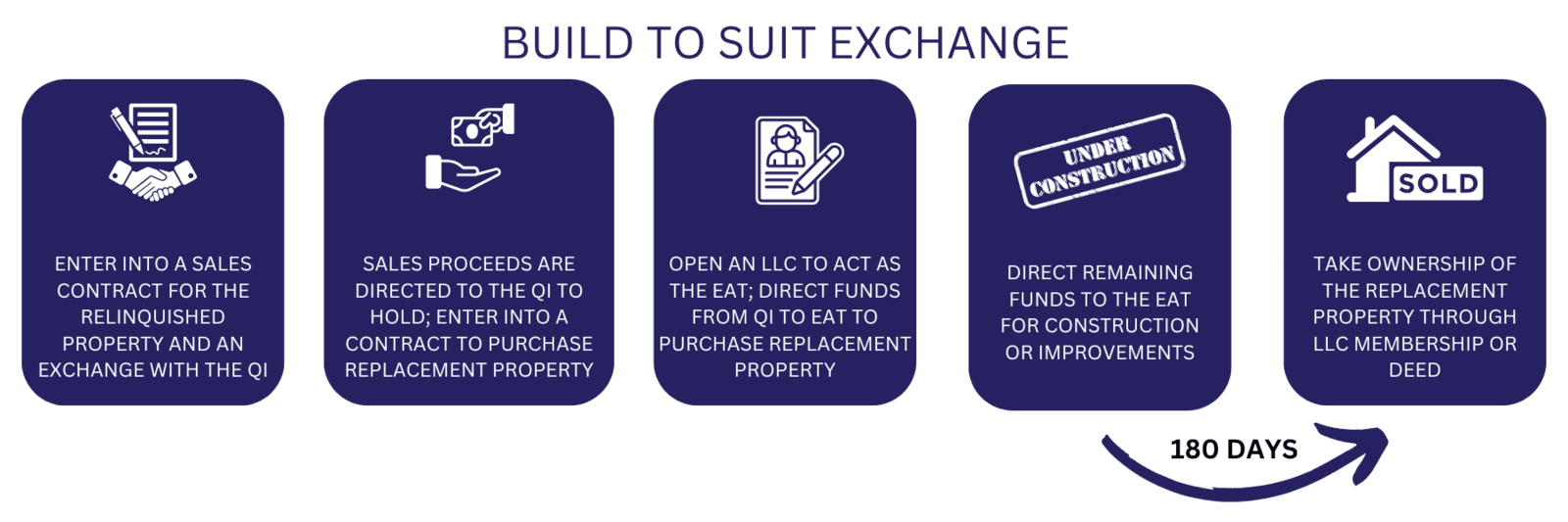

Improvement Exchange (Build-to-Suit)

This type allows you to use exchange funds to improve the replacement property. Imagine you sell a $1 million property but can only find a suitable replacement for $700,000. With an improvement exchange, you can use the remaining $300,000 for construction or improvements on the replacement property. The key requirements are:

- All improvements must be completed within the 180-day exchange period

- The property must be substantially the same as what was identified within the 45-day identification period

- The improvements must be in place before you take title to the property

Construction Exchange

Similar to an improvement exchange, but typically involves ground-up construction. The same 180-day timeline applies, which means all construction must be completed within this period. This can be challenging, so careful project management is essential.

Parking Arrangements

These are used in both reverse and improvement exchanges when one property needs to be "parked" with an EAT. There are two main types:

- Exchange First: The replacement property is "parked" with the EAT while you sell your relinquished property. This is typically used in reverse exchanges.

- Exchange Last: The relinquished property is "parked" with the EAT while improvements are made to the replacement property. This is common in improvement exchanges.

Simultaneous Exchange

This occurs when the closing of the relinquished property and the replacement property happen on the same day. While this seems simple, it's actually quite rare due to the complexity of coordinating multiple closings. There are three ways to structure it:

- Two-party trade

- Three-party exchange

- Simultaneous exchange with a qualified intermediary

Program Exchanges

These are used when you're doing multiple exchanges as part of a larger strategy. For instance, a company might sell several properties and acquire multiple replacement properties over time. This requires careful coordination and usually involves:

- Master exchange agreements

- Multiple qualified intermediaries

- Complex identification rules

- Detailed tracking systems